Understanding TNA's Dividend History and Volatility

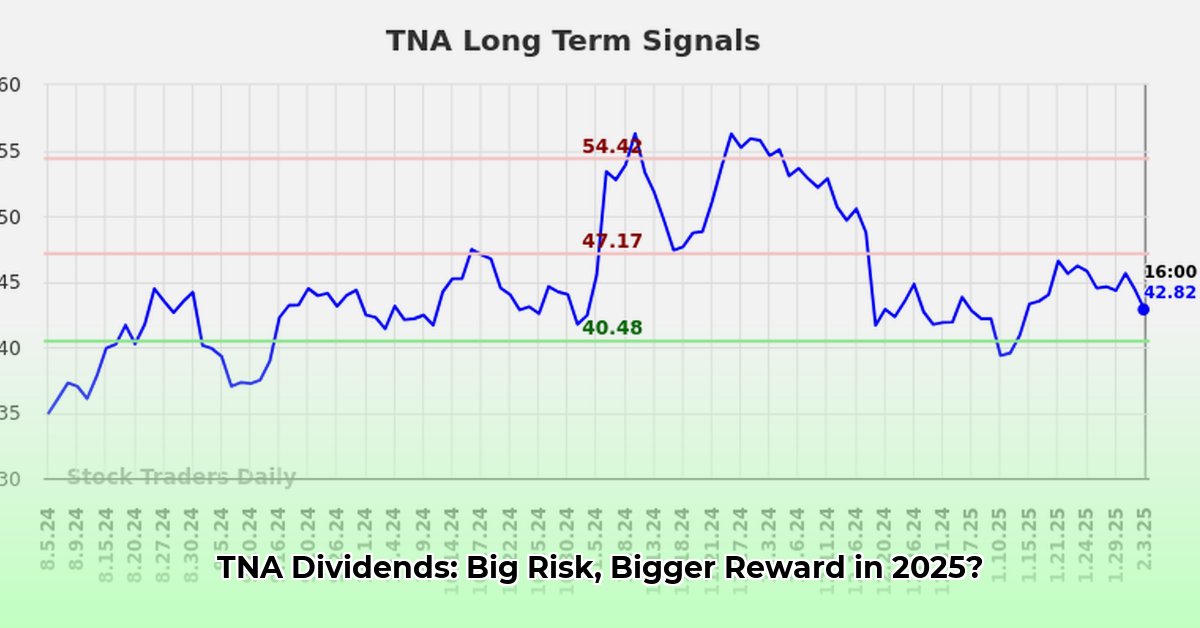

The Direxion Daily Small Cap Bull 3x Shares (TNA) ETF is a leveraged exchange-traded fund (ETF) designed to deliver 3x the daily performance of the Russell 2000 Index, a benchmark for small-cap U.S. stocks. This 3x leverage, while offering potential for amplified gains, significantly increases risk, leading to inconsistent and unpredictable dividend payouts. Recent data reveals a concerning 22.40% year-over-year decrease in TNA's dividend, highlighting the inherent volatility associated with this investment. But why the rollercoaster? Small-cap stocks are inherently volatile, and this inherent risk is compounded by TNA's 3x leverage. This volatility directly translates into fluctuating, and potentially disappointing, dividend payments. Is TNA's dividend history indicative of future performance? Let's delve deeper.

Risk Assessment & Mitigation Strategies for TNA Dividends

Investing in TNA dividends presents substantial risks. A detailed understanding of these risks and the implementation of effective mitigation strategies are crucial for responsible investing. The following table expands on potential risks and provides actionable mitigation strategies:

| Risk Factor | Likelihood | Impact | Mitigation Strategies |

|---|---|---|---|

| Dividend Cuts or Elimination | Very High | Very High | Diversify your portfolio across various asset classes (e.g., bonds, large-cap stocks, real estate). Limit TNA exposure to no more than 5% of your total portfolio. Consider alternative income sources. |

| Extreme Market Swings | Very High | Very High | Implement hedging strategies (e.g., options, inverse ETFs) to protect against losses. Utilize stop-loss orders to limit potential downside. Invest only the capital you can afford to lose completely. |

| Leveraged Investment Perils | Very High | Very High | Thoroughly understand the leveraged nature of TNA and its implications for both gains and losses. Manage expectations and avoid over-leveraging your portfolio. |

| Information Gaps | Medium | Medium | Conduct thorough independent research beyond marketing materials. Seek advice from a qualified financial advisor experienced in leveraged ETFs and high-risk investments. |

| Tax Implications | Medium | Medium | Consult a tax professional to fully understand the tax implications of dividends from leveraged ETFs, including potential for capital gains taxes. |

Dividend Analysis and Interpretation: Deciphering TNA's Payouts

Understanding key metrics is vital when assessing the value of TNA's dividends. The dividend yield, currently around 0.91%, appears modest. However, this seemingly low yield must be viewed within the context of the significant volatility inherent in TNA's investment strategy. A higher yield, in isolation, is deceiving when the actual dividends fluctuate unpredictably and present a substantial risk of reduction or complete elimination. We should also consider the payout ratio; this represents the percentage of the fund's earnings that are paid out as dividends. A consistently strong dividend requires robust underlying company financials – a company experiencing consistent losses will likely struggle to maintain a significant dividend payment. The relationship between the performance of the small-cap index and TNA's dividend payouts is particularly vital. A decline in the small-cap index is likely to negatively correlate with TNA's dividend payments.

Actionable Steps for Different Investor Profiles

Navigating TNA's dividend strategy requires different approaches tailored to individual investor profiles and risk tolerance:

| Investor Type | Short-Term Strategy | Long-Term Strategy |

|---|---|---|

| Income-Seeking Investor | Avoid relying on TNA as your primary income source; diversify for stability. | Maintain a small, well-diversified allocation to TNA (e.g., less than 5% of total portfolio). Regularly re-evaluate your strategy based on market conditions and risk tolerance. |

| Growth Investor | Use TNA cautiously for targeted, leveraged growth but brace for significant risk. | Employ advanced risk mitigation techniques such as hedging and options trading. Maintain a diversified portfolio to balance risk and potential rewards. |

Conclusion: Navigating the TNA Dividend Landscape

Investing in TNA dividends involves a significant degree of risk due to the inherent volatility of small-cap stocks and the 3x leverage. Effective risk management is paramount. This includes diversification, thorough research, realistic expectations, and a clear understanding of the potential for significant losses. Remember, the information presented here is for educational purposes only. Always conduct your own thorough due diligence before investing, and consult with a qualified financial advisor to get personalized guidance tailored to your specific financial situation and risk tolerance. Remember, past performance is not indicative of future results.